Financial leasing of professional equipment

Use your equipment without buying it. Preserve your cash flow, control your costs, and adopt a solution that is compatible with environmental issues.

What is financial leasing?

Financial leasing (or professional leasing) is a form of rental financing that allows a company to use equipment without purchasing it. It applies to many sectors and types of equipment (IT, industrial, medical, etc.) and is aimed at any organization wishing to control its investments, preserve its cash flow, and meet accounting or environmental constraints.

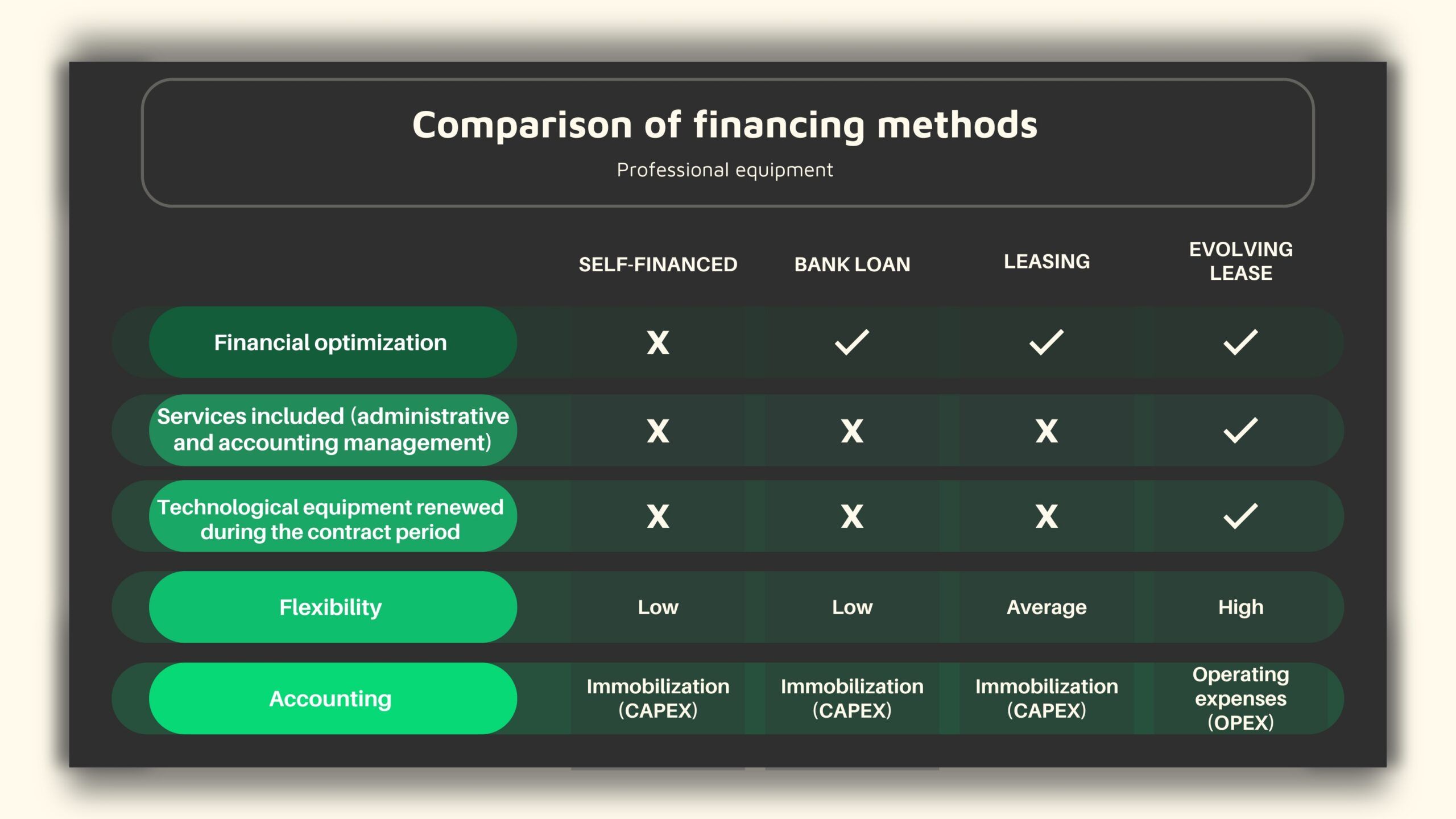

Comparison of financing methods

What makes financial leasing different from other financing methods (self-financing, bank loans, leasing)? Which solution is best suited to your project?

The advantages of financial leasing with Leasecom

- Gain flexibility: The contract can be modified to suit your needs from the very first month (additions, replacements, upgrades). A scalable solution with no constraints.

- Preserve cash flow: No capital tied up. The company retains its ability to invest elsewhere and meet its operational needs.

Control costs: Rentals are fixed and predictable. Optionally, they can include related services (installation, maintenance, recycling), for a clear view of the overall budget. - Simplify accounting management: Rentals are considered operating expenses. They do not weigh down the balance sheet and are not included in debt ratios.

- Reducing your environmental footprint: Leasing gives you access to reconditioned equipment, extends the life of your equipment, and ensures that it is disposed of in accordance with standards (WEEE, AGEC, CSRD).

A solution tailored to all sectors

Whether you are involved in industry, commerce, healthcare, construction, or services, financial leasing gives you quick access to the equipment you need for your business, without compromising on quality or durability.

Our markets

What equipment do we finance?

Integrate financial leasing into your sustainable performance strategy

At Leasecom, we see financial leasing as a pillar of responsible performance.

By choosing our model, you are adopting a circular approach that combines controlled use, recycling, reconditioning, and regulatory compliance. Financial leasing thus becomes a strategic tool that supports your economic, operational, and environmental challenges.

Would you like to learn more about financial leasing?

Discover our solutions designed to support your growth and meet your customers' expectations.